Revolutionary Banking: Unleashing The Power Of Technology Innovation In Banking

Technology Innovation in Banking

Welcome, readers! Today, we will delve into the fascinating world of technology innovation in banking. In recent years, the banking industry has seen a tremendous transformation due to advancements in technology. This article aims to provide you with a comprehensive overview of the various aspects of technology innovation in banking, its advantages and disadvantages, and how it has revolutionized the way we conduct financial transactions.

Introduction

In this digital age, technology has become an integral part of our lives, and the banking industry is no exception. Technology innovation in banking refers to the development and implementation of cutting-edge technologies to enhance banking services, improve customer experience, and streamline operations. These innovations have paved the way for a more efficient, secure, and convenient banking experience for customers worldwide.

2 Picture Gallery: Revolutionary Banking: Unleashing The Power Of Technology Innovation In Banking

The following table provides a detailed overview of technology innovation in banking:

Technology Innovation in Banking

Description

Online Banking

Allows customers to manage their finances, transfer funds, and pay bills online.

Image Source: bestarion.com

Mobile Banking

Enables customers to access banking services through mobile devices, offering convenience and flexibility.

Biometric Authentication

Uses unique biological traits, such as fingerprints or facial recognition, to verify customer identities.

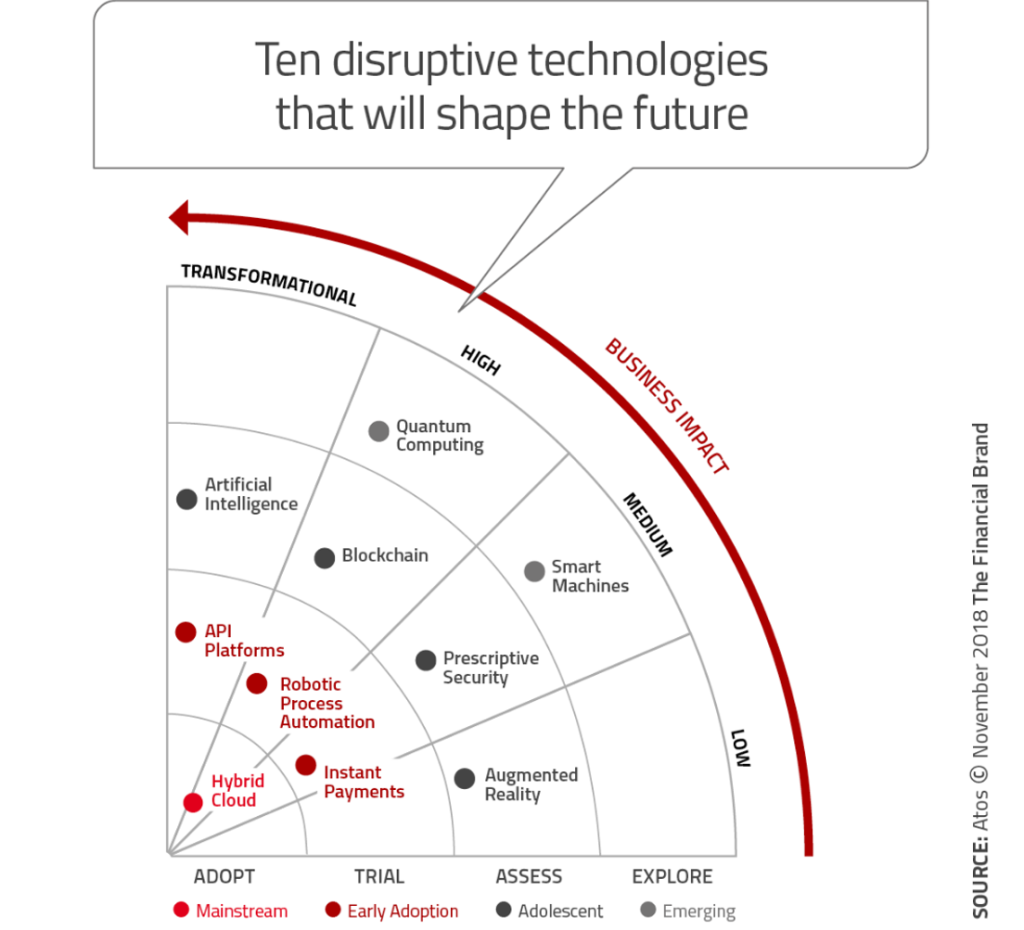

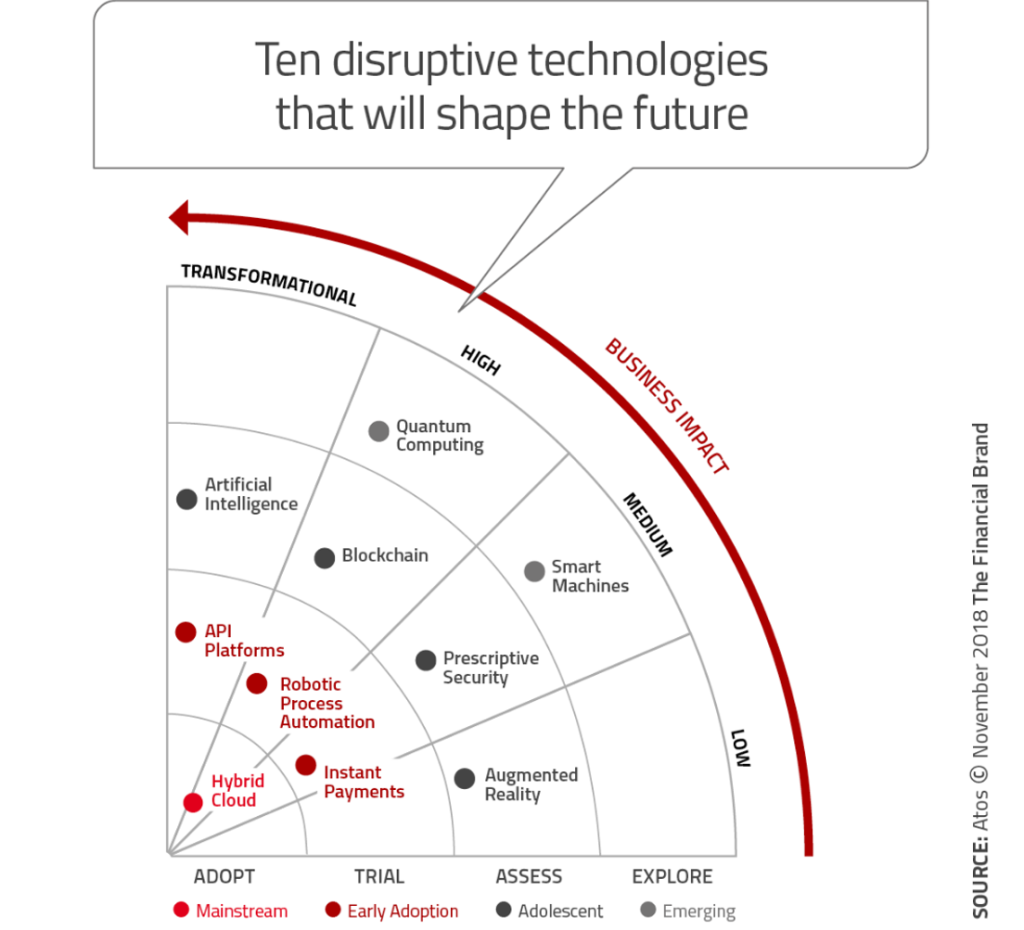

Artificial Intelligence

Employs algorithms and machine learning to analyze customer data, provide personalized recommendations, and automate customer service.

Blockchain Technology

A decentralized and transparent system that ensures secure and traceable transactions.

Robotic Process Automation

Automates repetitive tasks and processes, reducing human error and increasing efficiency.

What is Technology Innovation in Banking?

Image Source: startus-insights.com

Technology innovation in banking refers to the introduction and adoption of advanced technologies to improve banking services, enhance security, and optimize operational processes. It encompasses a wide range of innovations, such as online banking, mobile banking, biometric authentication, artificial intelligence, blockchain technology, and robotic process automation.

Emoji: 💡

These innovations have revolutionized the banking industry, making financial services more accessible, convenient, and secure for customers worldwide.

Who is Driving Technology Innovation in Banking?

Technology innovation in banking is driven by a combination of factors, including banks, financial technology (fintech) companies, regulatory bodies, and customer demand. Traditional banks are investing heavily in technological advancements to stay competitive and cater to the evolving needs of their customers.

Emoji: 👥

In addition, fintech companies, with their agile and innovative approach, are disrupting the industry by introducing new technologies and services. Regulatory bodies play a crucial role in fostering innovation while ensuring compliance with legal and security standards.

When Did Technology Innovation in Banking Begin?

Technology innovation in banking has been an ongoing process for decades. The advent of computers in the 1950s marked the beginning of automation in the banking industry. Since then, technological advancements have continued to reshape and revolutionize the way banks operate and serve their customers.

Emoji: ⏰

In recent years, with the rapid growth of digital technologies, the pace of innovation has accelerated, leading to significant disruptions and transformations in the banking sector.

Where is Technology Innovation in Banking Taking Place?

Technology innovation in banking is taking place globally. Banks and financial institutions around the world are embracing technology to bring about a digital banking revolution. Developed countries, such as the United States, United Kingdom, and Singapore, are at the forefront of technology adoption, while developing countries are also catching up rapidly.

Emoji: 🌍

Moreover, technology innovation in banking is not limited to physical branches. It extends to online platforms, mobile applications, and even wearable devices, allowing customers to access banking services anytime and anywhere.

Why is Technology Innovation in Banking Important?

Technology innovation in banking is of paramount importance for several reasons. Firstly, it enhances customer experience by providing convenient and efficient banking services. Customers can perform transactions, access account information, and seek support with just a few clicks on their devices.

Emoji: 💪

Secondly, technology innovation improves operational efficiency for banks. Automated processes, such as loan origination and account opening, reduce manual workloads, minimize errors, and expedite service delivery.

Thirdly, it strengthens security measures, protecting customers’ financial data from fraudulent activities. Biometric authentication, encryption techniques, and multi-factor authentication ensure the confidentiality and integrity of personal and financial information.

How Does Technology Innovation in Banking Work?

Technology innovation in banking works by leveraging advanced technologies to streamline banking operations and enhance customer services. Online and mobile banking platforms provide customers with the flexibility to perform various transactions, such as fund transfers, bill payments, and balance inquiries.

Emoji: 🔧

Artificial intelligence algorithms analyze customer data to provide personalized recommendations and improve fraud detection. Blockchain technology ensures secure and transparent transactions, eliminating the need for intermediaries.

Advantages and Disadvantages of Technology Innovation in Banking

Advantages:

1. Increased convenience: Customers can access banking services anytime and anywhere, reducing the need for physical branches.

2. Improved efficiency: Automated processes streamline operations, reducing manual workloads and human error.

3. Enhanced security: Advanced authentication methods and encryption techniques protect customers’ financial data.

4. Personalized experience: Artificial intelligence enables personalized recommendations and tailored financial solutions.

5. Cost savings: Technology innovation enables banks to reduce operational costs and pass on the savings to customers.

Disadvantages:

1. Cybersecurity risks: With increased technology adoption, the risk of cyber threats and data breaches also increases.

2. Technological barriers: Some customers may face difficulties in adopting new technologies, leading to a digital divide.

3. Job displacement: Automation and robotics may result in job losses for bank employees involved in repetitive tasks.

4. Privacy concerns: The collection and analysis of customer data raise privacy concerns among individuals.

5. Dependence on technology: System outages or technical glitches can disrupt banking services and affect customer experience.

Frequently Asked Questions (FAQ)

1. Are online banking transactions secure?

Yes, online banking transactions employ encryption techniques and secure authentication methods to protect customers’ financial data.

2. Can I access mobile banking services abroad?

Yes, as long as you have an internet connection, you can access mobile banking services anywhere in the world.

3. How does artificial intelligence improve banking services?

Artificial intelligence analyzes customer data to provide personalized recommendations, automate customer service, and improve fraud detection.

4. Is blockchain technology only used for cryptocurrencies?

No, blockchain technology has applications beyond cryptocurrencies. It ensures secure and transparent transactions in various industries, including banking.

5. What happens if I forget my biometric authentication details?

If you forget your biometric authentication details, you can still access your account using alternative methods, such as passwords or security questions.

Conclusion

In conclusion, technology innovation in banking has revolutionized the industry, making banking services more accessible, convenient, and secure than ever before. The adoption of online banking, mobile banking, biometric authentication, artificial intelligence, blockchain technology, and robotic process automation has transformed the way banks operate and serve their customers.

By embracing these technological advancements, banks can enhance customer experience, improve operational efficiency, and strengthen security measures. However, it is essential to address the challenges associated with technology innovation, such as cybersecurity risks, technological barriers, job displacement, privacy concerns, and dependence on technology.

Ultimately, technology innovation in banking is an ongoing journey, driven by customer demand, regulatory requirements, and the pursuit of a more efficient and customer-centric banking experience.

Final Remarks

Technology innovation in banking is an exciting and ever-evolving field. As advancements continue to shape the industry, it is crucial for banks and customers alike to embrace these innovations responsibly. While technology offers numerous benefits, it is vital to strike a balance between convenience and security, ensuring that customer data remains protected.

As you embark on your financial journey in this digital age, remember to stay informed about the latest advancements and exercise caution when engaging in online transactions. Together, we can harness the power of technology to create a better and more inclusive banking ecosystem.

This post topic: Technology Innovation